Importance of Correlation in Forex Market. Calculate Correlation

Importance of Correlation in Forex Market. Calculate Correlation in Forex. How to Calculate Correlation? What is Correlation

Correlations between products in the forex market are of great importance for risk management and strategy planning. Today, we will examine what is correlation in the forex market? How is it calculated and how it can be used when trading.

What is Correlation?

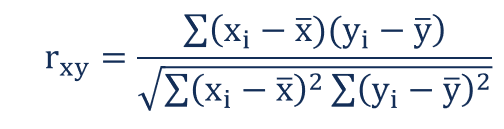

Correlation shows the relationship between two or more products and how these products react to each other. In the forex market, correlation usually shows the relationship between the price movements of two different products.

The correlation value can take a value between -1 and +1:

+1: Positive correlation. The two products move in the same direction.

0: No correlation. There is no relationship between the two products.

-1: Negative correlation. The two products move in the opposite direction.

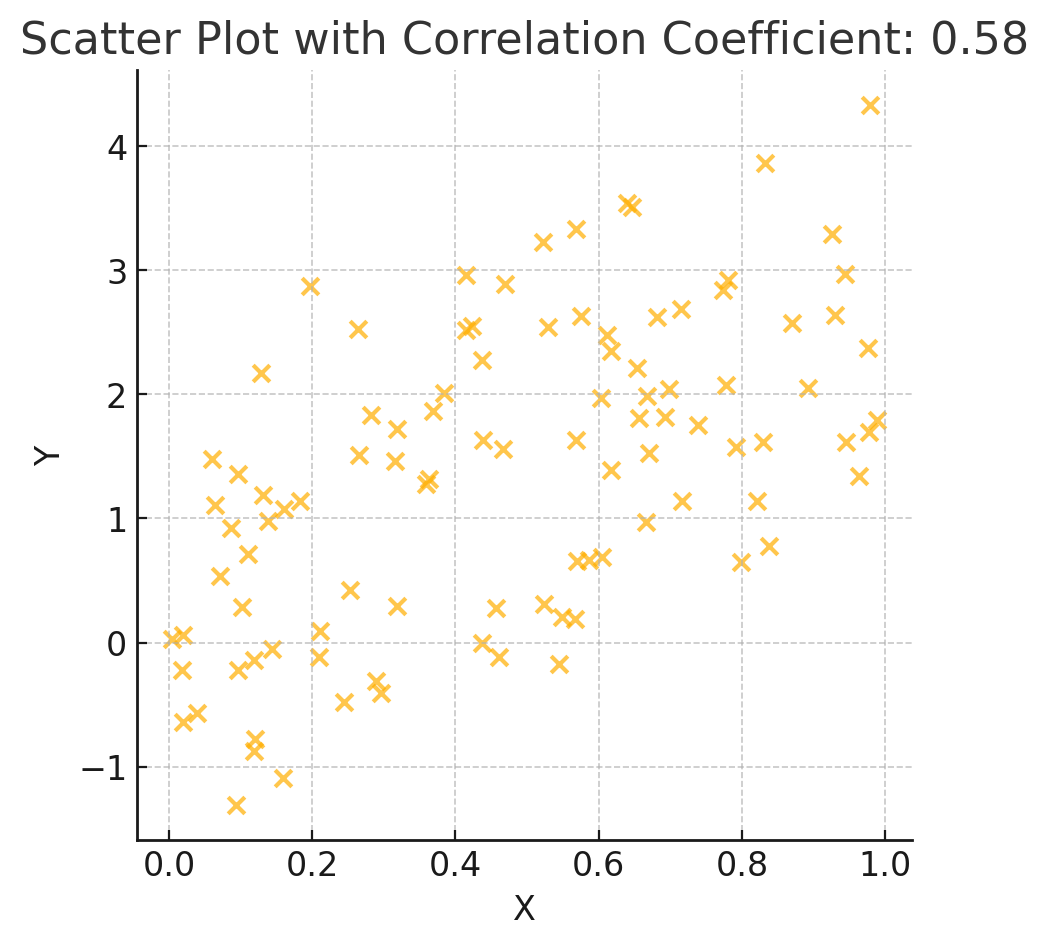

How is Correlation Calculated?

In the forex market, correlation is measured by the coefficient and is calculated using the Pearson correlation coefficient formula.

The Importance of Correlation in Forex

Understanding correlation offers several advantages for investors:

1. Risk Management: Trading between products with positive correlation can increase the risk in the portfolio. Products with negative correlation can help balance the risk.

2. Strategy Development: Correlations allow investors to develop more effective trading strategies in different market conditions. For example, an investor who sees a currency pair weakening can offset potential losses by taking a long position in another currency pair with a negative correlation.

3. Hedge Transactions: Using correlations, investors can protect against market fluctuations. They can hedge in products with a negative correlation to protect their positions.

Correlation Strategies in Forex

You can develop various trading strategies using correlations:

1. Pair Trading Strategy: This strategy involves choosing two highly positively correlated currency pairs and taking a long (buy) position in one and a short (sell) position in the other. This strategy can reduce risk since prices will move parallel to each other.

2. Diversification: Diversifying your investment portfolio is important for risk management. By using correlations, you can avoid currencies with positive correlations and prefer currencies with negative correlations.

3. Hedge Strategies: By taking positions in currencies with negative correlations, you can protect yourself from potential losses. For example, EUR/USD and USD/CHF pairs are generally negatively correlated.

Tracking Correlations in Forex

There are various tools and software to track and analyze correlations. Tools such as the correlation matrix show the correlation coefficients of different currencies and help investors make decisions. In addition, many forex brokers and trading platforms offer integrated correlation analysis tools that allow investors to easily access this data.

Understanding and using correlations in the forex market can help investors develop more informed and effective trading strategies. By taking correlations into account, you can manage risks, diversify your portfolio, and protect yourself against market fluctuations. However, it is important to remember that correlations can change over time; therefore, you should keep your strategies up to date by regularly performing correlation analyses.

In summary, correlation allows you to make more profit from products that move in the same direction and in the opposite direction in the Forex market, or to keep your losses to a minimum by opening hedge positions in case your transactions go wrong. For this, knowing the correlations between products and performing risk management and analyses accordingly will allow you to progress more healthily.